When Your Salary Isn’t the Problem: How Young Professionals Crash Financially (and How Tech Can Help You Breathe Again)

If you’re reading this, there’s a good chance you’re not lazy. You probably earn something decent. You might even look “okay” from the outside.

But inside?You’re always one or two bad months away from a crash. Debt hangs over your head. You’re scared of investing because you feel you don’t even control what you have now. You whisper to yourself, “I should know better by now.” I know this pattern too well—because I have lived it.

My Life on Reset: Floor, Crashes, and False Progress

I’ve lived in Lagos and other places, and for years my life looked like this:

- Work hard, hustle, try one more thing

- Make some money → feel hopeful

- Make a few wrong moves → money disappears

- Move to a new environment → sometimes back to sleeping on the floor

- Start a new skill or hustle → coding today, forex tomorrow, business next week

- Repeat.

On paper, I was “talented” and “hardworking.” In reality, I was restarting my life over and over, never truly moving forward.

I’ve literally bought beds and then left them behind when I moved again, only to end up on the floor in a new place—physically and financially.

At the same time, I’m a Christian. I pray. I care about honesty and building something real. So every crash didn’t just hurt my pocket, it hurt my soul.

And one day this hit me very hard:

Restarting is not the same as growing.

Changing jobs, cities, hustles, or even phones feels like progress. But if the same patterns stay, we just meet the same result in a different location.

You Are Not Alone: Two Real Stories From My Inbox

After I recently re-introduced myself to my email list, two messages came in that felt like my old reflection:

Story 1: The Drained MBA Student

“I just started a new job from my previous one and it’s draining. I’m crashing financially because I started my MBA without a financial plan. I’m in a lot of debt… I keep praying and hoping that I don’t overthink myself because it’s really making me sad.”

New job. Big dream. MBA. But no financial structure around it.

Result?

- Overwhelm

- Debt

- Silent fear that one day your mind will just snap

Sound familiar?

Story 2: The “Reasonable Salary” With No Discipline

“Yes… I don’t have the discipline enough to manage my finances even though I get some reasonable amount of salary. Also I feel skeptical about investing.”

The salary is not terrible. But there is no sense of control. Investing feels dangerous because there is no system to protect the money in the first place.

This is where many young professionals live:

- Not broke enough to call it poverty,

- but not stable enough to breathe.

The Real Issue Is Not Just Income. It’s Invisible Systems.

A new job without a money system = more sophisticated crash.

An MBA without a money system = educated crash.

A “reasonable salary” without a money system = soft life on social media, silent panic offline.

The real enemy isn’t your boss, the government, or even school fees.

The real enemy is living on vibes instead of systems.

Where Tech Enters the Story (And I Don’t Mean Crypto Signals)

People hear “tech” and think:

- Coding

- Startups

- Forex robots

- Whatever is trending on X/Twitter

But the most powerful tech for someone in your situation is much simpler:

Tools that help you see and control your money and time.

Before you chase “investments,” you need visibility and rules.

Case Study A: The MBA, the Debt, and the Draining Job

Problem:

- New, draining job

- MBA started without a financial plan

- Debt + emotional exhaustion

- Prays a lot, but mind is under pressure

First Tech Step: Visibility, Not Magic

Instead of jumping into investments, they simply create a tracking sheet using Google Sheets:

- Columns: Date | Description | Amount | Type | Category

- Track all money in and out

- Goal for Month 1: see the truth

Tech here is not “get rich quick.” Tech is “stop lying to yourself.”

Second Step: One Breathing Rule

“The moment money lands, move a small % (5–10%) into a Stability Account.”

Because if you cannot keep ₦5,000, you won’t control ₦5,000,000.

Case Study B: “I Earn Okay, But I Have No Discipline”

Problem:

- Reasonable salary

- Money leaks everywhere

- Fear of investing

First Tech Step: Automatic Separation

Open a second account or wallet → set automated transfers on salary day.

Discipline becomes a system, not a feeling.

Second Step: No-Judgement Money Log

Use a note app or sheet. Track for 30 days without guilt. The data will reveal:

- Your biggest leaks

- How much you could keep without stress

My Own Tech + Life Reset: What I Started Doing Differently

- One main income lane at a time

- Use task managers and calendars to stay focused

- Money visibility—every naira has a name

- No-touch account for automatic stability

- Turn tech from distraction into productivity

The crashes became less violent. The floor became a foundation.

Why I Built Betheloa.com

I built it to create a home for:

- Young professionals

- Nigerians balancing faith and ambition

- People tired of restarting every year

The site contains:

- Real stories

- Practical tech guides

- Case studies

What You Can Do Right Now (3 Steps)

- Set one tiny rule: move 5–10% the moment salary lands.

- Track your money for 30 days.

- Bookmark betheloa.com and return for new tools and case studies.

If you’ve ever felt like “I’m too smart to be this unstable,” this space is for you.

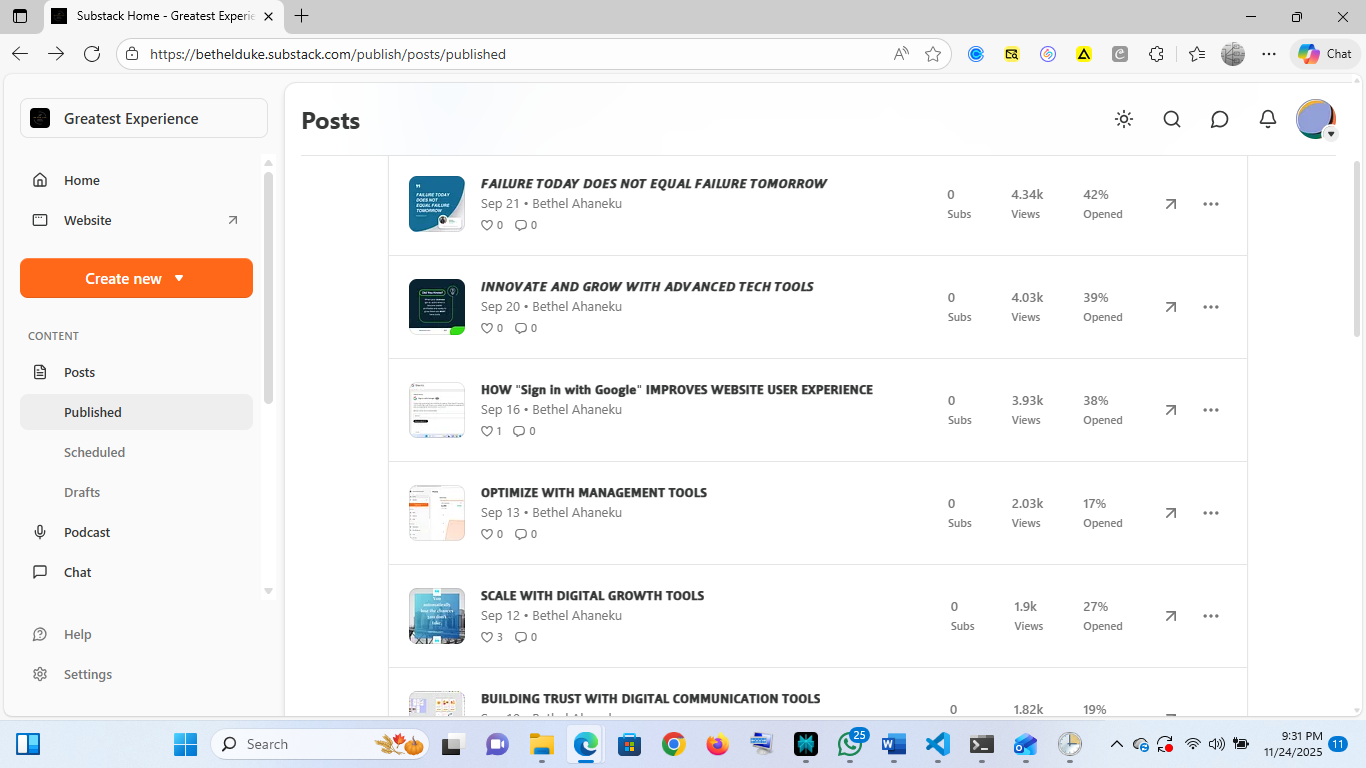

How I Design Content Flows That Keep Readers Coming Back

A quick look inside my Substack dashboard and the thinking behind posts that drive consistent opens, reads, and replies.

When I design a content system for a brand, I don’t start with “what should we post”. I start with what decision or feeling we want the reader to walk away with.

In the screenshot above, you’re seeing a slice of my own Substack: multiple posts, each focused on a specific pain point – management tools, growth tools, UX tweaks – all linked back to a simple call‑to‑action: book a strategy call or reply.

For clients, I use a similar approach:

- Define 3–5 recurring themes that match business goals.

- Map each theme to a mix of stories, how‑tos and case studies.

- Design landing pages and email flows that move readers closer to a decision.

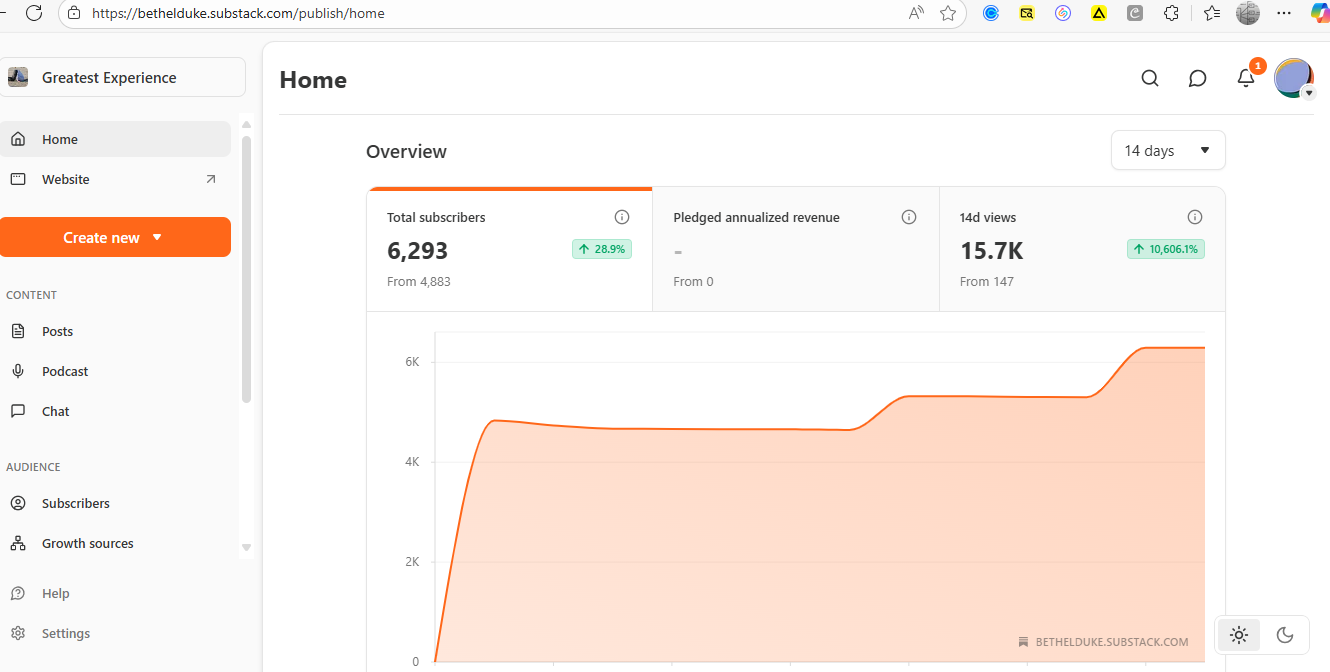

From 147 Views to 15.7K in 14 Days – What Actually Changed

A short breakdown of the UX, content and technical changes that turned a quiet blog into a repeatable growth engine.

The spike in traffic wasn’t an accident. It came from aligning three layers: experience, content, and distribution.

We simplified navigation, made key posts more scannable, and fixed technical issues that were slowing down the site. Then we re‑positioned the content and improved how it was shared with the existing audience.

The result was a 10,606% traffic lift without “viral” tricks – just focused improvements compounded together.